The World Bank has warned that Malawi remains at a high overall risk of debt distress, which could further undermine fiscal sustainability and frustrate strides towards economic recovery.

In its latest Malawi Economic Monitor titled From Crisis Response to a Strong Recovery launched in Lilongwe on Friday, the Britton Woods institution attributes this to the increased incurrence of high-cost domestic debt.

However, it says the risk associated with external debt is moderate, with some space to absorb shocks.

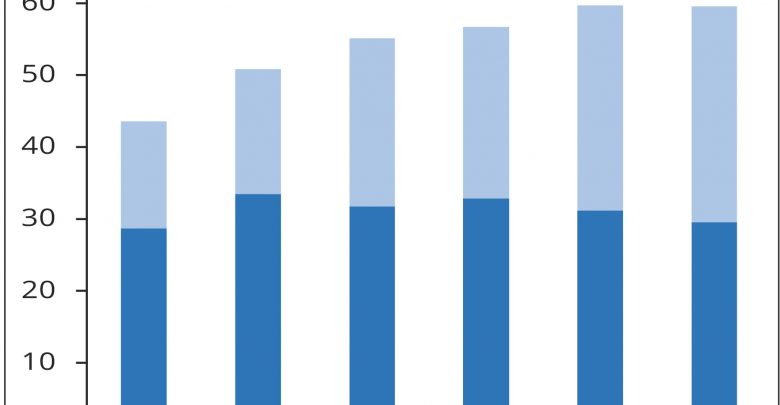

Domestic borrowing has continued to expand, increasingly through Treasury notes.

The government has been implementing a deliberate strategy to lengthen the maturity profile of domestic debt.

“This has resulted in the shift of domestic debt holdings from Treasury bills toward Treasury notes. However, increasing domestic borrowing has contributed to a substantial increase in interest rates on government borrowing,” says the bank in the report.

The World Bank says given significantly higher and increasing interest rates on T-notes—which currently range from 16 to 22 percent, compared against T-bills ranging from eight to 13 percent—this will contribute to higher interest expenditure.

It says with the government having stopped borrowing from the Reserve Bank of Malawi since early 2018, domestic debt is shifting toward commercial banks and the non-bank sector.

“Increasing domestic debt poses a high risk of undermining fiscal sustainability. The consistent financing of fiscal deficits by high cost domestic borrowing has led to a recent surge in domestic debt, and this is expected to rise further.

“This will increase vulnerability of public debt which is already at high risk of debt distress. Moreover, given the high and increasing cost of domestic debt, it will further narrow future fiscal space for discretionary policy,” says the World Bank.

It however, says there will be some room in the short term from external debt service relief by the IMF and other official bilateral creditors, estimated to save US$ 18 million in 2020.

The Britton Woods institution then called on the government to develop a deliberate policy to reduce the vulnerabilities that give rise to domestic debt.

“In particular, the government needs to improve budget planning and strengthen fiscal discipline if it is to bring domestic debt on a downward trajectory and reduce the risk exposure,” reads the report.

The World Bank predicts that the fiscal deficit would widen further beyond 10 percent of the Gross Domestic Product (GDP).

By the third quarter of the year, the government had already borrowed the equivalent of four percent of GDP from the domestic market, beyond the 3.4 percent of GDP in the revised budget.

By the end of 2019/2020 Financial Year, domestic borrowing could exceed seven percent of GDP.

In an interview yesterday, Treasury spokesperson, Williams Banda, said the government is already implementing systematic strategies in managing the debt levels.

“In line with the debt sustainability strategy, we are opting for concessionary and foreign denominated loans which is cheaper. We are working tireless to avoid domestic borrowing and when need rises; we would rather go for foreign loans which are cheaper and at lower rates,” Banda said.