Nigeria’s expanding digital economy took a significant step toward deeper global integration this week as Paga, one of the country’s earliest and largest fintech companies, made PayPal payments directly accessible to users across the country. The new integration allows Nigerians to link their PayPal accounts to Paga wallets, receive international payments and withdraw funds locally in naira.

For years, access to global payment platforms has been a persistent challenge for Nigerian freelancers, online merchants and small businesses, many of whom earn in foreign currencies but struggle to convert or use those funds within the local financial system. The Paga-PayPal linkage is intended to bridge that gap, connecting global earnings to everyday financial activity inside Nigeria.

Flutterwave Acquires Stake in Mono to Deepen Open Banking Across Africa

With the integration now live, users can receive cross-border payments from PayPal-supported markets, shop with international merchants and access their balances directly through Paga. Funds can be withdrawn to local bank accounts, spent via card, used to pay bills or transferred to merchants within Paga’s ecosystem, reducing friction between international income and local spending.

The move also expands opportunities for Nigerian businesses seeking customers abroad. By linking into PayPal’s global network of more than 400 million users, merchants and entrepreneurs in Nigeria are positioned to sell goods and services internationally while settling earnings locally, a shift that could prove especially valuable for small businesses operating online.

The development comes as Nigeria’s digital payments market continues to grow rapidly. Transaction values reached an estimated 657.8 trillion naira in 2023, according to industry data, alongside a steady rise in mobile wallet adoption. More than 30 million Nigerians are now active mobile wallet users, reflecting a broader shift toward cashless and digital financial services.

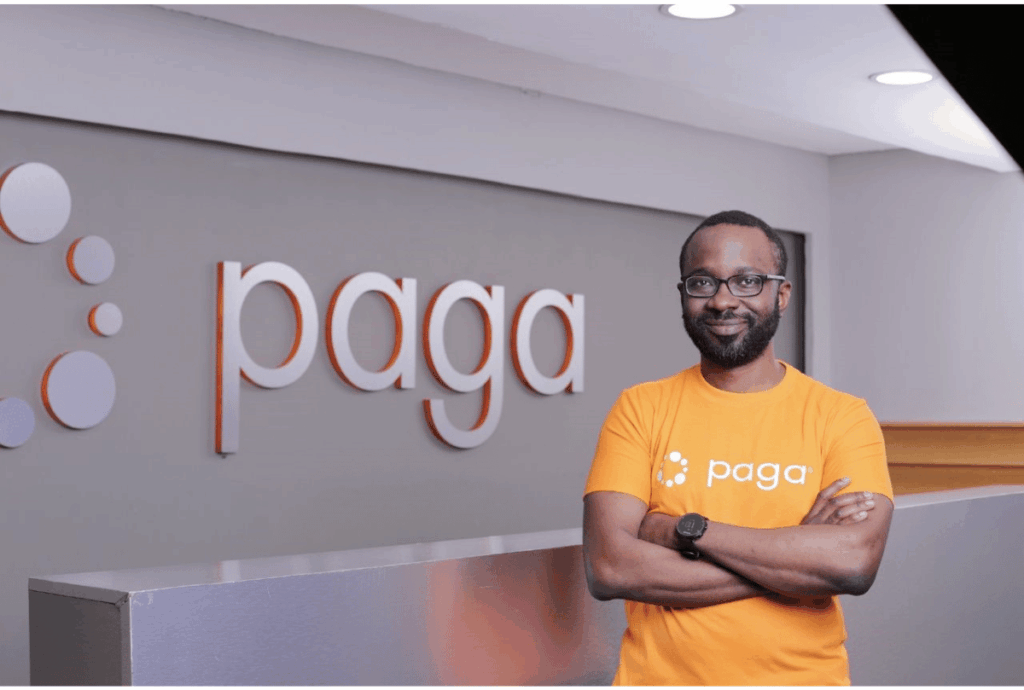

Paga, which serves over 21 million users, has built extensive local infrastructure through its digital wallet, bank transfer capabilities and card integrations. That footprint allows global payment flows to settle within Nigeria’s domestic financial system, rather than remaining trapped offshore.

Company executives said the collaboration was designed to make international payments simpler and more accessible for everyday users, including freelancers, online sellers and consumers who shop globally. PayPal executives described the partnership as part of a broader strategy to work with local platforms to expand financial inclusion and strengthen regional payments ecosystems.

Beyond convenience, analysts say the integration reflects a broader trend in Nigeria’s fintech sector: the localisation of global financial tools. Rather than replacing domestic platforms, international players are increasingly partnering with Nigerian firms that understand local regulations, settlement systems and consumer behavior.

As cross-border commerce becomes more central to Nigeria’s digital economy, the ability to earn globally and spend locally is expected to play a growing role in small business growth, job creation and participation in the global digital marketplace. For many Nigerians, the Paga-PayPal link represents not just a new feature, but a long-awaited connection between global opportunity and local reality.