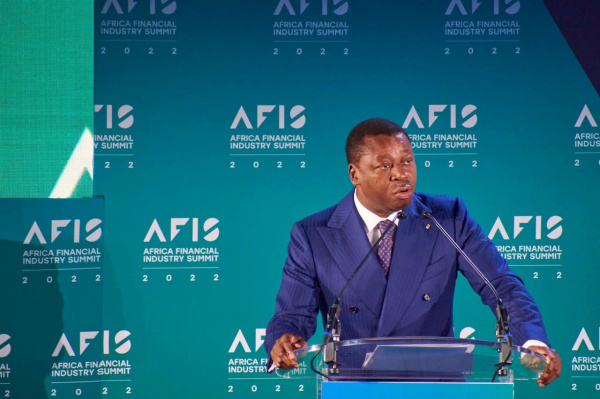

LOMÉ, TOGO – The Africa Financial Industry Summit (AFIS) held in Lomé, Togo, organized by the pan-African magazine Jeune Afrique, has emerged as a pivotal event, gathering over 800 leaders to deliberate on the significant strides and challenges faced by the African financial sector.

Read More Empowering Women for Peace

Despite facing obstacles, the continent’s financial institutions are gaining global prominence as international competitors withdraw, creating an unprecedented opportunity to expand the influence of the African financial sector.

Key imperatives for the industry include effectively managing growing public debt, adapting to climate challenges, and identifying new sources of finance. Serge Ékué, Chairman of the Board of Directors of the West African Development Bank, emphasized the vital role of effective regulation in ensuring the rapid and sustainable growth of the sector.

The summit spotlighted discussions on international loans, revealing that the cost of borrowing in sub-Saharan Africa is up to 2.1% higher on world markets, placing a substantial burden on local governments. Uzziel Ndagijimana, Rwandan Minister of Finance and Economic Planning, called for rating agencies to consider structural factors more comprehensively to address this issue.

Tokenization of assets emerged as a central theme, introducing the innovative concept of converting goods into digital tokens for online trading, potentially unlocking a significant volume of liquidity by making high-value assets more accessible.

Read More: AGOA Is Cornerstone of U.S. Economic Ties With Africa

The rising importance of cyber-insurance was also addressed, recognizing the growing threat of cyber-attacks on African banks. Alain Kaninda, Director General of the Regulatory Authority, highlighted an average of 2,164 attacks per week.

In just three years, AFIS has solidified its position as a crucial event, convening African financial leaders to navigate the challenges and opportunities in this thriving sector.